Any amount not distributed is taken to be re-invested in the business called retained earningsThe current year profit as well as the retained earnings of previous years are. Prudential Regulations shall be applicable to CIC as defined in clause viii of sub-para 1 of paragraph 3 of these Directions.

Dividend As per Section 235 of Companies Act 2013 defines the term as including any interim dividend.

. Declaration and Payment of Dividend Rules 2014. In the current years balance sheet 2016-17 how the accounting effect to be given to the final. 17 of 1982 as the case may be.

The declaration timing amount and payment of future dividends remain at the discretion of the Board of Directors. SGST - State Acts. THE COMPANIES ACT 2013 _____ ARRANGEMENT OF SECTIONS _____ CHAPTER I PRELIMINARY SECTIONS 1.

IDT old. Dividend Payout Ratio means the ratio between the amount. Of Model Articles of Company Limited by shares as Contained in Table-F of Schedule-I of the 2013 Act.

To amend Part 9 of the Enterprise Act 2002. An Act to reform company law and restate the greater part of the enactments relating to companies. Companies Act 2013.

DECLARATION AND PAYMENT OF DIVIDEND 123. PC-Biz includes the most current text of all overtures and reports that will be considered by the assembly. It has two principles ie 1 the dividend is to be paid out of the companys profits.

Company means a company registered under section 3 of the Companies Act 1956 or a corresponding provision under Companies Act 2013. To make other provision relating to companies and other forms of business organisation. Rule 1 to 10.

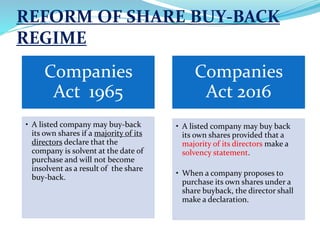

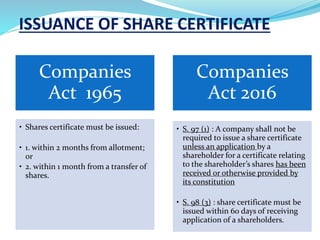

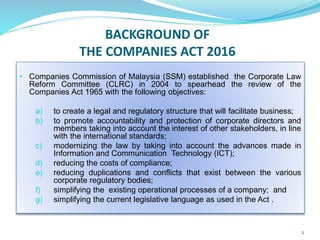

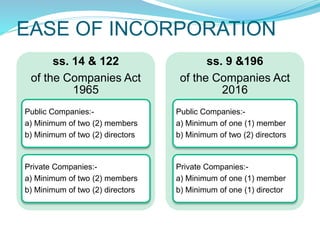

To vote on a resolution or to any right to participated beyond a specified amount in any distribution whether by way of dividend or on redemption in a winding up or otherwise. Removal of Name of Companies from the Register of Companies Rules 2016. The Companies Act 2016 CA 2016 repealed the Companies Act 1965 CA 1965 and changed the landscape of company law in Malaysia.

There are two types of dividends interim and final. DECLARATION AND PAYMENT OF DIVIDEND. SGST - State Circulars.

Refer Chapter VIII of the Companies Act 2013 from Sections 123 to 127 and the Companies Declaration and Payment of Dividend Rules 2014 for provisions on Declaration and Payment of Dividend. Provincial Council. Vi Companies in the group shall mean an arrangement involving two or more.

Unless it is registered in the manner and within the time prescribed by section 102 of this Act or by section 91 of the Companies Act No. Download complete list of Chapters and Topic wise all Sections of Companies Act 2013 as amended by the Companies Amendment Act 2020 in PDF format. The outside liabilities of a CIC shall at no point of time exceed 25 times its Adjusted Net Worth as on the date of the last audited balance sheet as at the end of the financial year.

Chapter V Prudential Regulations. DIVIDEND- SECTION 235 Where in simple words dividend can be defined as the sum of money paid by a company to its shareholders out of the profits made by a company if so authorised by its articles in. SECTION 123 TO 127 OF COMPANIES ACT 2013 READ WITH THE COMPANIES DECLARATION AND PAYMENT OF DIVIDEND RULES 2014.

And 2 the dividend should not be paid if the payment will cause the. Short title extent commencement and application. And to prohibit the payment of any dividend to its members.

Constitution Amendment Act 2016. Templates of shareholders resolution for declaration of. Where a declaration has been made and lodged in pursuance of section 257.

And for connected purposes. Everything you need to participate in the 225th General Assembly 2022 can be found on this Information Hub page. In the CA 2016 the dividend rule is found in s131.

Rule 1 to 3. Annex XIV - Declaration and Undertaking by Director. Application of insolvency rules in winding up of insolvent companies Omitted wef.

In most companies the company directors must hold a board meeting to officially declare interim dividends. SGST - State Notifications. A dividend is a distribution of profits by a corporation to its shareholders.

162016 on 26 th December 2016 the process of striking off the name of the Company from the Register of Companies through the Fast Track Exit often called FTE stands revisedThe Fast Track Exit mode and. Resignation of auditor under The Companies Act 2016. Pursuant to the provisions of Section 1246 of the Companies Act 2013 read with the Investor Education and Protection Fund Authority Accounting Audit Transfer and Refund Rules 2016 Ordinary Shares of the Company in respect of which dividend entitlements have remained unclaimed for seven.

When a corporation earns a profit or surplus it is able to pay a proportion of the profit as a dividend to shareholders. Transfer of Ordinary Shares to the Investor Education and Protection Fund. The setting of dividend record dates and the declaration and payment of dividends are subject to the Board of Directors approval.

With notification of Section 248-252 by the MCA vide Notification No. All dividends paid by the Corporation on its common shares and preference shares in the current fiscal year have been or will be designated as eligible dividends for the purpose of entitling shareholders of the Corporation. Right to dividend rights shares and bonus shares.

Direct Tax Goods. Chapter XIX Revival and Rehabilitation of Sick Companies Rules 2014. To issue a final dividend shareholders must grant their approval by passing an ordinary resolution at a general meeting or in writing.

This dividend qualifies as an eligible dividend for Canadian income tax purposes. To make provision about directors disqualification business names auditors and actuaries. Investor Education and Protection Fund.

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

The Malaysian Companies Act 2016

Preference Shares Case Facts By Hhq Law Firm In Kl Malaysia

Capital Reduction Under Companies Act 2016 Client Alert March 2018 Capital Reduction Under Studocu

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

The Malaysian Companies Act 2016